Gold isn’t just a shiny metal in India — it’s emotion, tradition, and investment rolled into one. Whether you're buying jewellery for a wedding or investing in gold coins, understanding how gold rate is calculated in India can help you make smarter financial decisions. Without taking much hustle, you can check the gold prices from the Gold Rate Calculator, which gets updated every day.

The base price of gold is determined by international markets, especially the London Bullion Market Association (LBMA). Prices are quoted in USD per ounce (1 ounce = 28.35 grams). These rates fluctuate based on global factors like inflation, interest rates, geopolitical tensions, and central bank decisions.

For example, if gold trades at $2,000/oz globally, that’s the benchmark. But in India, we first need to convert this into rupees.

Since international gold prices are in dollars, the USD to INR exchange rate plays a big role. A weaker rupee makes gold more expensive for Indian buyers. So even if international prices stay flat, a falling rupee can increase domestic gold rates.

India imports most of its gold, and the government levies duties on these imports. As of now, the main components are:

These taxes significantly inflate the final price paid by the end consumer.

Gold sold in India is mostly 22 carat (91.6% pure) for jewellery and 24 carat (99.9% pure) for investment. Since the global price refers to pure 24k gold, prices are adjusted for purity.

For example, if the 24k price is ₹6,000/gram, the 22k rate would be proportionally less — around ₹5,500/gram — depending on daily rates and vendor margins.

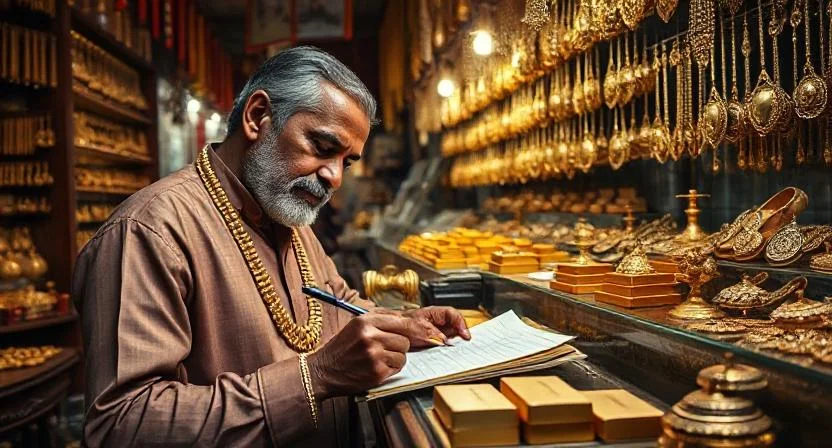

When buying jewellery, making charges (typically 8–20%) are added for design and craftsmanship. Some jewellers charge a flat rate, others calculate it as a percentage of the gold price. There’s also a small dealer margin, which varies by city and store.

You’ll often notice that gold price in Chennai is slightly different from gold price in Delhi or Mumbai. That’s because logistics, local demand, and competition affect city-level pricing. Most jewellers follow daily updates from the Indian Bullion & Jewellers Association (IBJA). Gold Rate Calculator updates more than 100+ city gold prices every day.